Condo Insurance in and around Winston Salem

Here's why you need condo unitowners insurance

Protect your condo the smart way

Home Is Where Your Condo Is

As with anything in life, it is a good idea to expect the unexpected and strive to prepare accordingly. When owning a condo, the unexpected could look like damage to your largest asset from vandalism theft, freezing pipes, and other causes. It's good to be aware of these possibilities, but you don't have to fret over them with State Farm's great coverage.

Here's why you need condo unitowners insurance

Protect your condo the smart way

Condo Unitowners Insurance You Can Count On

You can sleep soundly with State Farm's Condo Unitowners Insurance knowing you are prepared for the unanticipated with fantastic coverage that's right for you. State Farm agent Danielle Waller can help you understand all the options, from a Personal Price Plan®, bundling to possible discounts.

If you want to learn more, State Farm agent Danielle Waller is ready to help! Simply call or email Danielle Waller today and say you are interested in this excellent coverage from one of the leading providers of condo unitowners insurance.

Have More Questions About Condo Unitowners Insurance?

Call Danielle at (336) 923-4019 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.

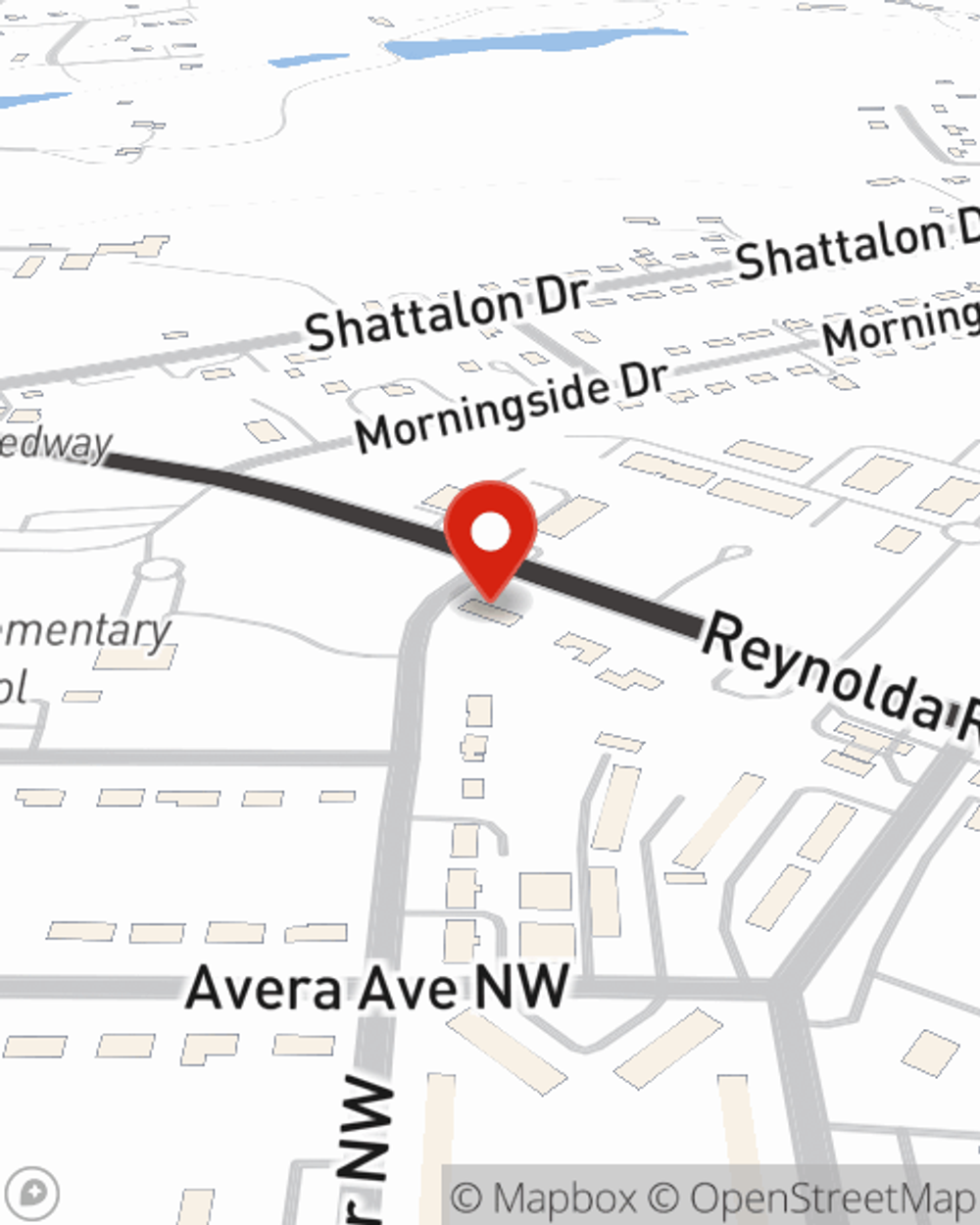

Danielle Waller

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Plumbing maintenance tips

Plumbing maintenance tips

Home plumbing problems can cause major damage. Performing a home plumbing checkup regularly can help to avoid plumbing issues. Read more tips.